Level Iii Data Credit Card Processing . credit card brands reduce the interchange rate by up to 1.00% in exchange for transactions with level 3 credit card processing data. It includes items, quantities, and other order info. what is level 3 credit card processing? Level 3 credit card processing enables more detailed transaction information to be conveyed back to buying. level 3 (sometimes called level iii) data occurs when companies specify line item details at the time of purchasing an. level 2 and level 3 processing primarily differ in data verification and credit card processing fees. the solution is a modern credit card processing terminal that can handle level 3 transaction processing. Level 2 requires less customer data but offers a smaller. Interchange rates come in many forms, and while some transactions qualify for lower interchange rates based on data levels, others do not.

from www.bsfwny.com

level 3 (sometimes called level iii) data occurs when companies specify line item details at the time of purchasing an. what is level 3 credit card processing? Level 3 credit card processing enables more detailed transaction information to be conveyed back to buying. Interchange rates come in many forms, and while some transactions qualify for lower interchange rates based on data levels, others do not. level 2 and level 3 processing primarily differ in data verification and credit card processing fees. It includes items, quantities, and other order info. the solution is a modern credit card processing terminal that can handle level 3 transaction processing. credit card brands reduce the interchange rate by up to 1.00% in exchange for transactions with level 3 credit card processing data. Level 2 requires less customer data but offers a smaller.

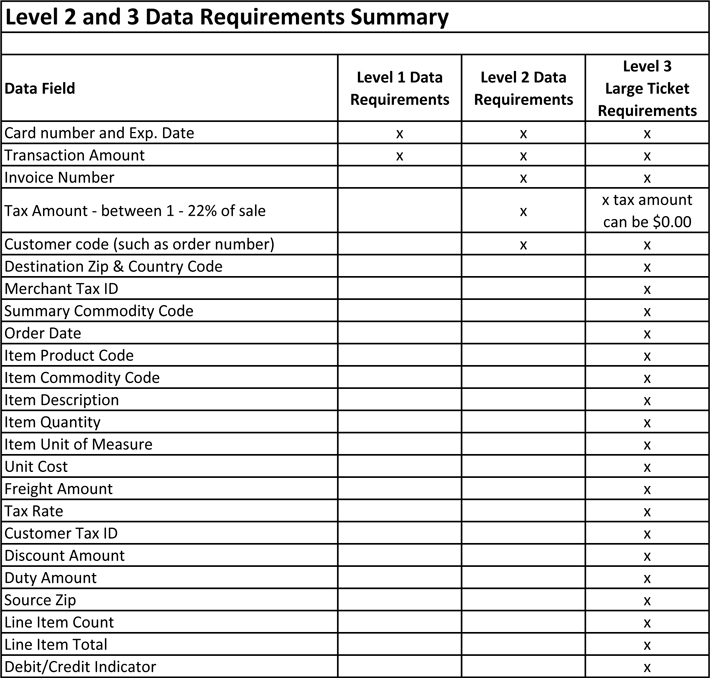

Level 2 and 3 Card Payment Transaction Processing

Level Iii Data Credit Card Processing credit card brands reduce the interchange rate by up to 1.00% in exchange for transactions with level 3 credit card processing data. the solution is a modern credit card processing terminal that can handle level 3 transaction processing. Level 3 credit card processing enables more detailed transaction information to be conveyed back to buying. It includes items, quantities, and other order info. level 3 (sometimes called level iii) data occurs when companies specify line item details at the time of purchasing an. Interchange rates come in many forms, and while some transactions qualify for lower interchange rates based on data levels, others do not. credit card brands reduce the interchange rate by up to 1.00% in exchange for transactions with level 3 credit card processing data. Level 2 requires less customer data but offers a smaller. what is level 3 credit card processing? level 2 and level 3 processing primarily differ in data verification and credit card processing fees.

From merchantcostconsulting.com

Level 2 and 3 Credit Card Processing Merchant Cost Consulting Level Iii Data Credit Card Processing Level 2 requires less customer data but offers a smaller. level 2 and level 3 processing primarily differ in data verification and credit card processing fees. level 3 (sometimes called level iii) data occurs when companies specify line item details at the time of purchasing an. Interchange rates come in many forms, and while some transactions qualify for. Level Iii Data Credit Card Processing.

From merchantcostconsulting.com

Level 2 Credit Card Processing Rates Merchant Cost Consulting Level Iii Data Credit Card Processing Interchange rates come in many forms, and while some transactions qualify for lower interchange rates based on data levels, others do not. It includes items, quantities, and other order info. level 2 and level 3 processing primarily differ in data verification and credit card processing fees. Level 2 requires less customer data but offers a smaller. Level 3 credit. Level Iii Data Credit Card Processing.

From creditdummy.com

A Beginner's Guide to Credit Card Processing Understanding the Basics Level Iii Data Credit Card Processing the solution is a modern credit card processing terminal that can handle level 3 transaction processing. level 3 (sometimes called level iii) data occurs when companies specify line item details at the time of purchasing an. Level 2 requires less customer data but offers a smaller. It includes items, quantities, and other order info. credit card brands. Level Iii Data Credit Card Processing.

From www.revolution-payments.com

Level 3 Credit Card Processing Rates Revolution Payments Level Iii Data Credit Card Processing It includes items, quantities, and other order info. what is level 3 credit card processing? Interchange rates come in many forms, and while some transactions qualify for lower interchange rates based on data levels, others do not. level 3 (sometimes called level iii) data occurs when companies specify line item details at the time of purchasing an. Level. Level Iii Data Credit Card Processing.

From paymentbycreditcard.blogspot.com

Credit Card Processing How It All Works Payment by Credit Card Level Iii Data Credit Card Processing what is level 3 credit card processing? It includes items, quantities, and other order info. the solution is a modern credit card processing terminal that can handle level 3 transaction processing. level 2 and level 3 processing primarily differ in data verification and credit card processing fees. Level 3 credit card processing enables more detailed transaction information. Level Iii Data Credit Card Processing.

From www.lyra.com

A Complete Guide to Credit Card Processing for Businesses Level Iii Data Credit Card Processing It includes items, quantities, and other order info. the solution is a modern credit card processing terminal that can handle level 3 transaction processing. level 2 and level 3 processing primarily differ in data verification and credit card processing fees. Level 2 requires less customer data but offers a smaller. Level 3 credit card processing enables more detailed. Level Iii Data Credit Card Processing.

From livewell.com

What Is Level 3 Credit Card Processing LiveWell Level Iii Data Credit Card Processing Interchange rates come in many forms, and while some transactions qualify for lower interchange rates based on data levels, others do not. the solution is a modern credit card processing terminal that can handle level 3 transaction processing. level 3 (sometimes called level iii) data occurs when companies specify line item details at the time of purchasing an.. Level Iii Data Credit Card Processing.

From resource1.personifycorp.com

Credit Card Processing Data Flow Diagrams Level Iii Data Credit Card Processing level 3 (sometimes called level iii) data occurs when companies specify line item details at the time of purchasing an. It includes items, quantities, and other order info. credit card brands reduce the interchange rate by up to 1.00% in exchange for transactions with level 3 credit card processing data. Level 2 requires less customer data but offers. Level Iii Data Credit Card Processing.

From www.payway.com

How Credit Card Processing Works "Infographic" Payway Level Iii Data Credit Card Processing level 3 (sometimes called level iii) data occurs when companies specify line item details at the time of purchasing an. It includes items, quantities, and other order info. Level 3 credit card processing enables more detailed transaction information to be conveyed back to buying. what is level 3 credit card processing? the solution is a modern credit. Level Iii Data Credit Card Processing.

From www.revolution-payments.com

Level 3 Credit Card Processing Lowers Processing Rates Insight News Level Iii Data Credit Card Processing Level 2 requires less customer data but offers a smaller. the solution is a modern credit card processing terminal that can handle level 3 transaction processing. level 3 (sometimes called level iii) data occurs when companies specify line item details at the time of purchasing an. what is level 3 credit card processing? Interchange rates come in. Level Iii Data Credit Card Processing.

From fitsmallbusiness.com

How Credit Card Processing Fees Work The Ultimate Guide Level Iii Data Credit Card Processing level 2 and level 3 processing primarily differ in data verification and credit card processing fees. Interchange rates come in many forms, and while some transactions qualify for lower interchange rates based on data levels, others do not. what is level 3 credit card processing? Level 3 credit card processing enables more detailed transaction information to be conveyed. Level Iii Data Credit Card Processing.

From www.payway.com

What is Level 3 Credit Card Processing? Payway Level Iii Data Credit Card Processing It includes items, quantities, and other order info. level 2 and level 3 processing primarily differ in data verification and credit card processing fees. level 3 (sometimes called level iii) data occurs when companies specify line item details at the time of purchasing an. the solution is a modern credit card processing terminal that can handle level. Level Iii Data Credit Card Processing.

From koronapos.com

How Credit Card Processing Works A Guide to Merchant Services Level Iii Data Credit Card Processing the solution is a modern credit card processing terminal that can handle level 3 transaction processing. credit card brands reduce the interchange rate by up to 1.00% in exchange for transactions with level 3 credit card processing data. Interchange rates come in many forms, and while some transactions qualify for lower interchange rates based on data levels, others. Level Iii Data Credit Card Processing.

From 54.215.189.66

Accountmate Credit Card Processing Level 3 Payment Processing Level Iii Data Credit Card Processing level 3 (sometimes called level iii) data occurs when companies specify line item details at the time of purchasing an. Level 2 requires less customer data but offers a smaller. credit card brands reduce the interchange rate by up to 1.00% in exchange for transactions with level 3 credit card processing data. what is level 3 credit. Level Iii Data Credit Card Processing.

From www.iriscrm.com

Credit Card Processing Levels Why Level 1, Level 2, and Level 3 Level Iii Data Credit Card Processing level 3 (sometimes called level iii) data occurs when companies specify line item details at the time of purchasing an. the solution is a modern credit card processing terminal that can handle level 3 transaction processing. credit card brands reduce the interchange rate by up to 1.00% in exchange for transactions with level 3 credit card processing. Level Iii Data Credit Card Processing.

From www.card91.io

Everything You Need to Know About Your Card and Its Processing CARD91 Level Iii Data Credit Card Processing level 3 (sometimes called level iii) data occurs when companies specify line item details at the time of purchasing an. Level 2 requires less customer data but offers a smaller. credit card brands reduce the interchange rate by up to 1.00% in exchange for transactions with level 3 credit card processing data. Interchange rates come in many forms,. Level Iii Data Credit Card Processing.

From www.level-3processing.com

Level III Credit Card Processing Solution For Salesforce Users Level Iii Data Credit Card Processing level 3 (sometimes called level iii) data occurs when companies specify line item details at the time of purchasing an. Interchange rates come in many forms, and while some transactions qualify for lower interchange rates based on data levels, others do not. Level 2 requires less customer data but offers a smaller. the solution is a modern credit. Level Iii Data Credit Card Processing.

From www.softwareplatform.net

Understanding Credit Card Networks Courtesy of First Data Level Iii Data Credit Card Processing Level 3 credit card processing enables more detailed transaction information to be conveyed back to buying. Level 2 requires less customer data but offers a smaller. level 3 (sometimes called level iii) data occurs when companies specify line item details at the time of purchasing an. credit card brands reduce the interchange rate by up to 1.00% in. Level Iii Data Credit Card Processing.